WHAT WILL BE THE FUTURE OF INSURANCE SECTOR?

Insurers have always held on to their traditions, but the industry’s current pace, appetite, and proclivity to change, has a significant effect on the current acceleration in the market. Since past few years, the pace of customer needs has been on the rise, while the industry faces challenges to keep up. Keeping in mind the changing expectations and digitalization that may occur, big companies such as Geico, Progressive, and State Farm have already started playing it in the digital arena. This has already given them a head-start compared to their competitors and other mid-sized insurers. Further, speculations have proven that the insurance industry is growing at a rate of 9% per year, which is faster than the average upsurge in career opportunities or finance industry (Published by Eagle Insured Advisors).

Improvised policy options and increasing careers opportunities are not the only avenues where we can see a boom. Evolving consumer preferences and digitization of the sector are two major upcoming trends that we’ll witness in the nearby future.

Artificial Intelligence

Reaching out to prospective customers at the right time, understanding their needs and providing them with the right product are the three major challenges that the insurance industry is facing presently. Artificial Intelligence is expected to find effective solutions for most of these problems, if not all. Using IoT sensors, personalized data of potential customers could be attained for pricing platforms. Through behavioral policy pricing and smart analysis, Artificial Intelligence is expected to redefine the insurance ecosystem.

Customer Experience

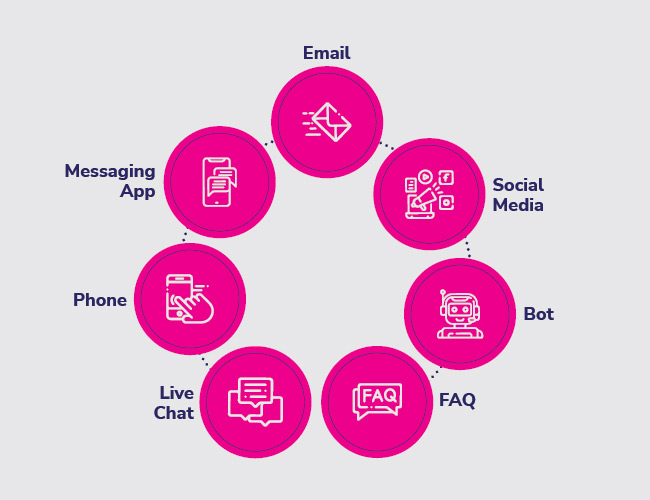

A seamlessly automated buying experience is key to the success of any insurance company, for it helps to get new prospects and retain the existing customers. In this case, your customer’s need is probably what you need to crack first. Apart from coverage personalization and policy rates, what most of the customers look out for is a seamless buying experience. Some of the upcoming trends reveal that a considerable number of insurers will focus on individual transactions to build a smooth, effortless and connected customer experience. Channel innovations are also disrupting the insurance industry. These channels were evolved as a result of insurers’ urge to enhance their operational efficiencies, aided by advanced technology. These channels have made it easy for the insurers to reach their customers without going through any of the traditional intermediary channels.

Blockchain

Insurance giants are increasingly using the blockchain technology — a cryptographically secured form of record keeping, to prevent fraud and to digitally track medical records. Studies have shown a proliferating interest in insurance technologies in the blockchain. In the coming years, you can expect an upsurge in the amount of insurance led blockchain patent activity. With a potential to improve back-office efficiency, simplify processes and reduce cost, the blockchain technology is believed to have a disruptive power for business transformation and re-invention.

Internet of Things

Internet of Things is all about linking your electronics to the internet. The insurance sector is highly going to benefit from this connectivity as the focus is going to shift from repair to prevention. Think about connected homes, buildings, office spaces, cars, and devices. By regularly monitoring usage and risk, the scope of protecting your property, gadgets and other assets are high and the cover could also become much more fluid.

Dynamic underwriting, predictive analysis, customer control and quantum computing are some of the other key trends that are going to disrupt the future of insurance industry. Smart solutions, unique services, and seamless product delivery are some of the main elements that are going to change the face of the insurance sector. 3i Infotech Limited is an organization committed to empowering business transformation. To uniquely position your company by addressing the dynamic requirements of your customers, partner with 3i Infotech.

Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Mr. Umesh Mehta

Mr. Umesh Mehta Uttam Jhunjhunwala

Uttam Jhunjhunwala

Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N Ramu Bodathulla

Ramu Bodathulla

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan

Nilesh Gupta

Nilesh Gupta Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra