AI IN BANKING: THE ROAD TO ADOPTION

AI technologies are making inroads into the financial sector, transforming it and making banking easier, faster, and more personalized. From improved consumer experience and better products to fraud prevention, the implementation of AI in the Banking and Financial Services Industry (BFSI) has powered the sector to take on complex challenges and deliver results that meet customer expectations. According to a World Economic Forum (WEF) 2018 report, AI has created new operating models and has infused a new kind of competitive dynamics that augur well for the financial sector.

The banking sector has shown notable alacrity in the adoption of AI. A FinTech India report published by PwC in 2017 pegged the global spending on AI applications to $5.1 billion. The Indian banking sector has also shown eagerness in adopting AI. In fact, India’s largest public sector bank, SBI, conducted a ‘Code For Bank” hackathon in 2018 to motivate developers to build solutions powered by technologies like AI. According to the Accenture Banking Technology Vision 2018 report, 83% of Indian bankers believe that AI will work along with human in the next two years.

So where exactly can we see a greater adoption of AI in banking? Here’s a list.

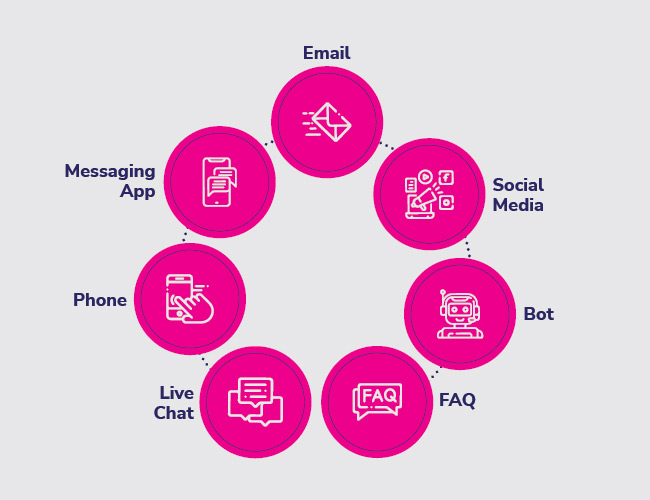

Customer Service: According to Gartner, 85 % of all customer interactions will be automated by 2020. More banks are expected to adopt AI-driven solutions like chatbots to ensure a faster, easier, and hassle-free customer experience.

Personalized products: AI can analyze various data to provide great insights into customer behaviour. It will help banks to create more personalized portfolios and offer improved wealth management solutions.

Process optimization: The application of AI to automate low-value but high-volume tasks will find more takers.

Fraud detection: Use of AI has delivered excellent results in detecting banking frauds, and its adoption is expected to grow in the future.

Security: Adoption of AI to dispel security threats, including cybersecurity breaches, is projected to increase in the coming years.

Trading: Banks are already using AI for trading in security markets and AI utilization is expected to grow in this area.

Why is it an imperative?

Adoption of AI in banking is no longer a matter of choice but a business imperative. Here’s why:

Improved service: Adoption of AI ensures deep insights into customer behaviour enabling banks to provide better products. Also, conversational AI tools like chatbots make customer interaction more responsive and valuable.

Better security: AI ensures real-time detection of fraud and predicts and tracks security breaches which make banking more safe and secured.

Faster processes: Automation and digitization driven by AI make banking faster and efficient.

Reduced costs: According to Autonomous, a leading financial research firm, AI adoption is projected to save the banking industry $1 trillion by 2030.

How we can help you

Investing in the right AI technology is vital for boosting operational efficiency, enhancing revenue generation, and improving customer relations of banks. We address the entire gamut of requirement of the BFSI sector and provide user-centric solutions. Our offerings include conversational banking solutions and other products and services powered by AI, automation, and other cutting-edge technologies to help you take your business to the next level. Please visit our website.

Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD)

Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD) Mr. Umesh Mehta

Mr. Umesh Mehta Mr. Raj Kumar Ahuja

Mr. Raj Kumar Ahuja

Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Uttam Jhunjhunwala

Uttam Jhunjhunwala

Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N Ramu Bodathulla

Ramu Bodathulla

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan

Nilesh Gupta

Nilesh Gupta Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra