BANCASSURANCE: Brighter Years Ahead

As economy grows rapidly, it demands stronger and livelier financial sector. Insurance is a highly significant aspect of India, as sales overpower purchases. Indian financial system has recorded an average growth of over 8.5 per cent for the last four years, with macroeconomic indicators suggesting improved growth given there is rich monsoon.

What is Bancassurance?

Although, there are various channels for marketing insurance products, rural India comprises of approximately 70% of mass. This calls for a unique channel which enables to bring insurance products within the reach of the common man. This route is adopted through a local bank branch, which is alternatively called Bancassurance channel.

How does it work?

Bancassurance, an upcoming business model, enables insurance companies to sell products through bank distribution channels. Banks benefit by enriching the customers’ portfolio. Insurers have access to customer databases and profiles, which gives them an opportunity to purchase a broader range of products and services to meet their demanding needs.

Future of Bancassurance

The concept of bancassurance was originated in the European countries and spread gradually into India post 2000. The channel alone contributed to 5.57% and 2.23% in 2006-2007 under channel-wise new business performance.

Bancassurance, a sector which is still in the maturing stage, is a different channel of insurance. The maturity differs with different regions. The good news? It is expected to grow at a high rate in the coming years. The channel is also expected make rapid growth globally at a CAGR of 5.29% between 2013 and 2017.

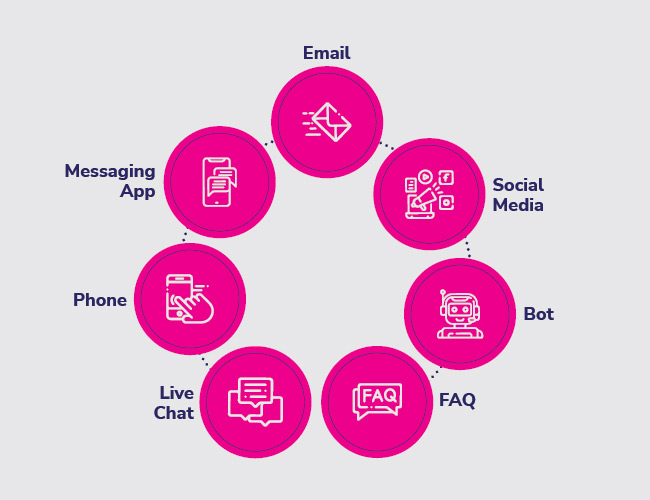

Agents and brokers still form the major distribution network. While alternative channels like social media and internet are on the rapid rise, Bancassurance favours the customers with flexibility and convenience.

In Asia-Pacific, bancassurance is still an emerging subject matter. In the process of depositing funds in financial institutions through bancassurance, customers benefit from reduced premium prices, high quality product, and delivery. Although, the channel has not often been in debate in the recent years, it is set to rise swiftly. Expect faster improvements related to customer service and entry of large foreign insurance players. The global presence of insurance players has paved ways to bancassurance growth in Latin America. Data collected by Government of India show that the total number of accounts opened under Prime Minister Jan Dhan Yojana Scheme (PMJDY) is driven towards financial stood at 18.96 Crores with a new balance of 25,899 Crore.

Challenges in Bancassurance

Like any other emerging field, bancassurance also poses a few challenges that you must be aware.

- Bancassurance channel resonates with “push” products, which demands a different mindset while communicating with the rural & semi-urban section of India

- Insurance profit development poses a threat to successful operation of bancassurance

- Established insurance set ups like LIC & its subsidiaries have a large market share, making it tougher for the new entrants

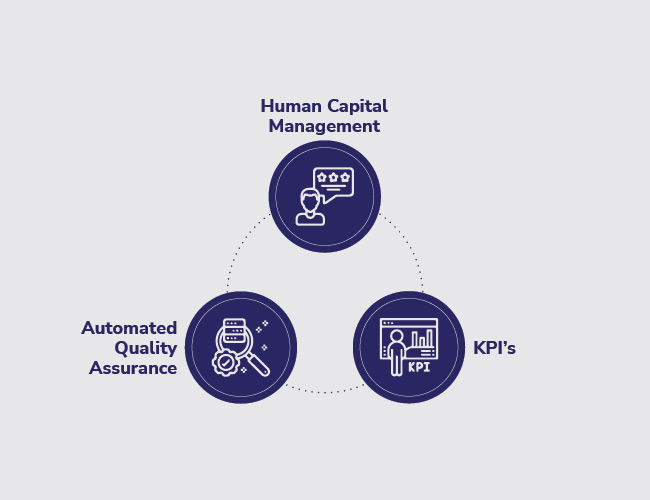

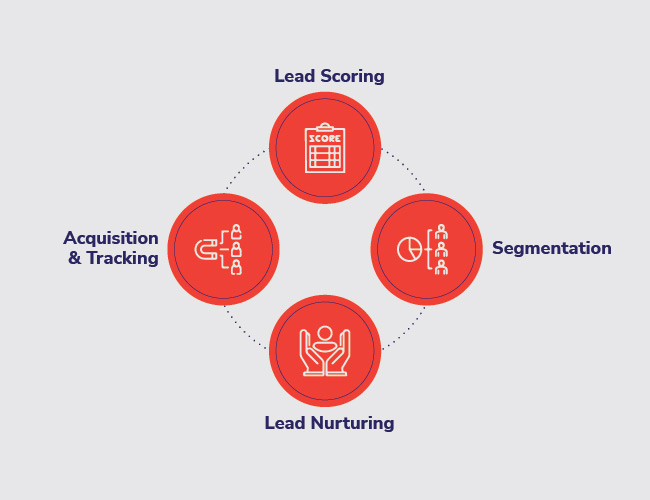

Bancassurance success depends on the extent of advanced technology utilised for banking operations. Banking and insurance have converged in India and striving for bigger dreams for the betterment of the rural section of the country. 3i Infotech delivers highly-efficient bancassurance solutions, which leads to a substantial & a holistic growth. Know more here https://bit.ly/2LpcJcn

Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD)

Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD) Mr. Umesh Mehta

Mr. Umesh Mehta Mr. Raj Kumar Ahuja

Mr. Raj Kumar Ahuja

Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Uttam Jhunjhunwala

Uttam Jhunjhunwala

Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N Ramu Bodathulla

Ramu Bodathulla

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan

Nilesh Gupta

Nilesh Gupta Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra