Revolutionizing BFSI with 3i Infotech’s Cloud Solutions

Cloud computing has revolutionized the way businesses operate in today’s digital age. The financial services industry has not been left behind in this transformation, with many firms embracing cloud technology to streamline their operations, reduce costs, and increase efficiency.

The BFSI sector has been a major adopter of cloud technology in recent years, as it has enabled banks to modernize their legacy IT systems, drive operational efficiency, and enhance customer experience. The cloud-first approach has become increasingly popular as it provides flexibility, scalability, and cost-effectiveness to banks. According to a report by MarketsandMarkets, the cloud computing market in the BFSI sector is expected to grow from $17.8 billion in 2020 to $46.8 billion by 2025, at a CAGR of 21.9%.

As an on-prem to edge digital transformation orchestrator, 3i Infotech helps banks transition to the cloud seamlessly. The company’s cloud-first approach helps banks modernize their IT systems and leverage cloud-native services to enhance agility, scalability, and cost-effectiveness. 3i Infotech’s expertise in app modernization has helped banks re-architect their legacy systems for the cloud, making them more agile and resilient.

Security is a top priority for BFSI firms, and 3i Infotech’s SASE (Secure Access Service Edge) solution provides a holistic approach to security by combining network security and zero-trust access. SASE provides secure access to cloud applications and data from any device and location, making it ideal for banks that have a distributed workforce. According to Gartner, the SASE market is expected to grow from $1.5 billion in 2020 to $5.1 billion by 2024.

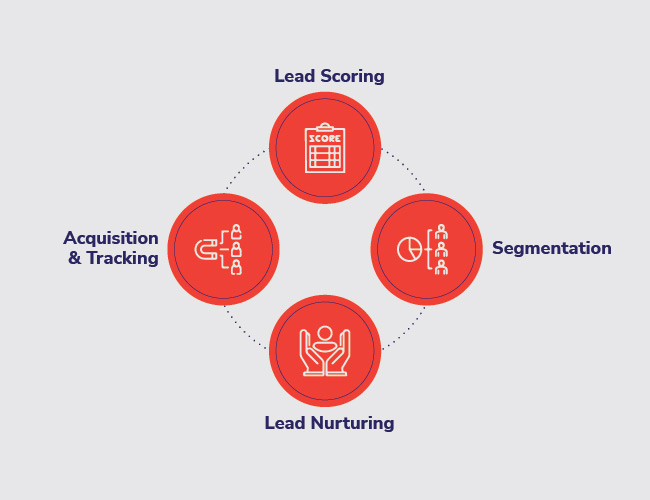

Automation is another area where 3i Infotech helps banks enhance efficiency and reduce costs. The company’s automation solutions leverage AI and machine learning to automate routine tasks and streamline workflows. According to a report by Accenture, banks that invest in automation could reduce operating expenses by up to 30%.

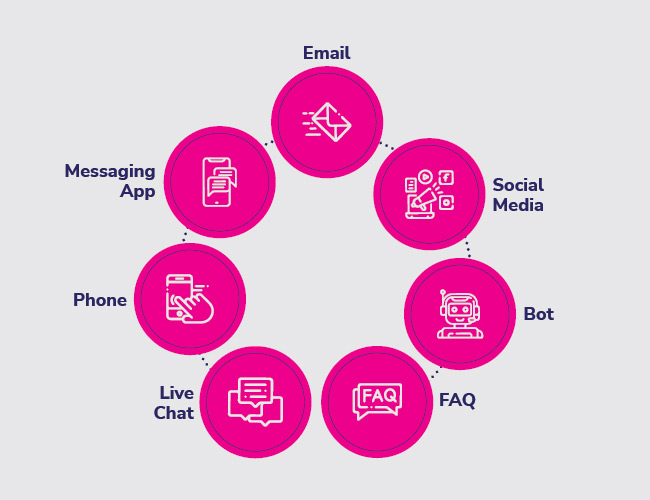

Analytics and insights are critical for banks to make informed decisions and deliver personalized customer experiences. 3i Infotech’s analytics solutions help banks derive insights from their data to improve customer engagement, identify risks, and optimize operations. According to a report by IDC, banks that leverage advanced analytics could improve customer satisfaction by up to 10%.

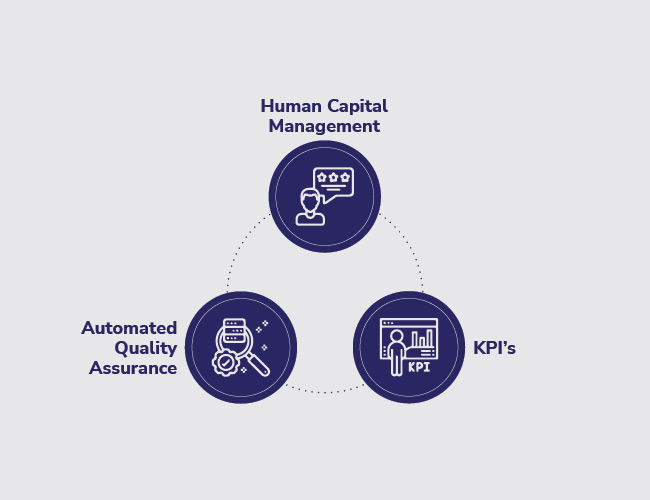

Finally, 3i Infotech’s CXO cockpit provides a single glass pane view of bank operations and health, enabling CXOs to make informed decisions in real-time. The CXO cockpit provides drill-down capabilities for people, processes, and KPIs, making it easy for CXOs to identify and resolve issues quickly. According to a report by McKinsey, companies that adopt data-driven decision-making could increase their productivity and profitability by up to 6%.

In conclusion, the BFSI sector’s adoption of cloud technology has increased significantly in recent years, and 3i Infotech’s cloud-first approach helps banks modernize their legacy IT systems, drive operational efficiency, and enhance customer experience. The company’s expertise in app modernization, AWS, security, SASE, automation, analytics insights, and CXO cockpit provides banks with a comprehensive solution to their cloud needs. With a strong track record in the BFSI sector and a global presence across 5 continents, 3i Infotech is well-positioned to help banks transition to the cloud and drive digital transformation.

Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD)

Dr. Madan Bhalchandra Gosavi (B.A. (Hons.), LLM, M.Phil, PhD) Mr. Umesh Mehta

Mr. Umesh Mehta Mr. Raj Kumar Ahuja

Mr. Raj Kumar Ahuja

Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Uttam Jhunjhunwala

Uttam Jhunjhunwala

Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N Ramu Bodathulla

Ramu Bodathulla

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan

Nilesh Gupta

Nilesh Gupta Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra