Time To Move Away From Spreadsheets For Risk Assessment?

Risk for an enterprise is anything that could cause damage or loss to the business or make achieving strategic objectives more difficult. What is considered risk varies from one entity to another. Risk can be internal, such as faulty processes, or external, such as a change in the competitive environment.

Enterprise Risk Management (ERM) is a framework for managing risk so that a business can successfully achieve its objectives. Every enterprise should decide what it perceives as a risk and carry out a risk assessment. Besides protecting the enterprise from harm the process can also reveal opportunities to improve business performance. Properly managing risk is also a key factor for Business Continuity Management (BCM). BCM involves the identification of potential threats and establishing a plan in case those threats are realized, making sure the company can continue to deliver on its obligations to clients, counterparties, and employees.

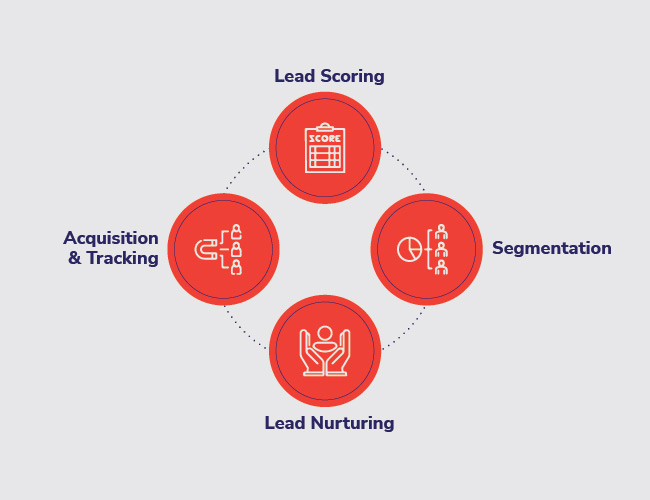

Every enterprise should undergo a business analysis during which risks are identified. These risks are then categorized, for example as regulatory, reputational, financial, IT, Infrastructure, HR, ESG etc. and assigned to the people or departments which are responsible for assessing them. This process of assessment involves analysis based on several factors, some qualitative and others quantitative, which may vary from risk to risk. Combining all these factors is a challenge for any spreadsheet as the scope and depth of the assessment is difficult to display in a user-friendly manner. Additionally, the whole risk assessment process becomes siloed and difficult to co-ordinate and there is no audit trail underlying it.

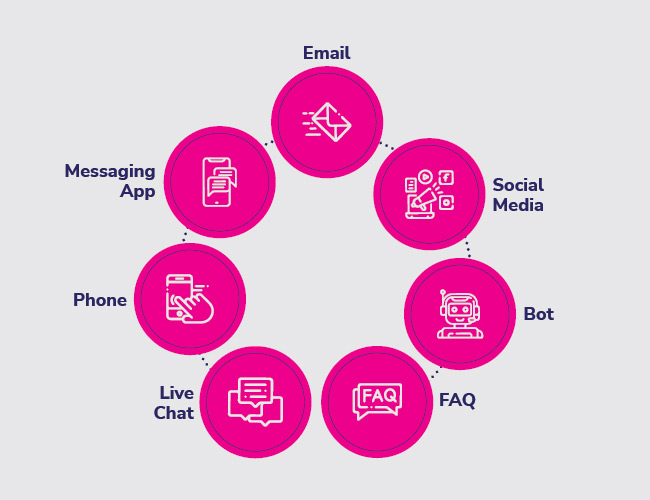

Even if it were possible to display the whole picture on a spreadsheet, keeping the risk assessments current is a daunting task and very time consuming. It is time to free your experts from manual, siloed activities and enable them to make timely and informed decisions using interactive dashboards, heat maps and reports. The ROI for an ERM system is not only due to the time and cost savings from elimination of manual and siloed processes but also from avoiding errors or delays in action which could be expensive due to fines from regulators, falling short of business goals or reputational damage.

A Modern ERM should increase the likelihood of meeting your business goals by mitigating or avoiding risks but also revealing opportunities. This goes way beyond a graded check list.

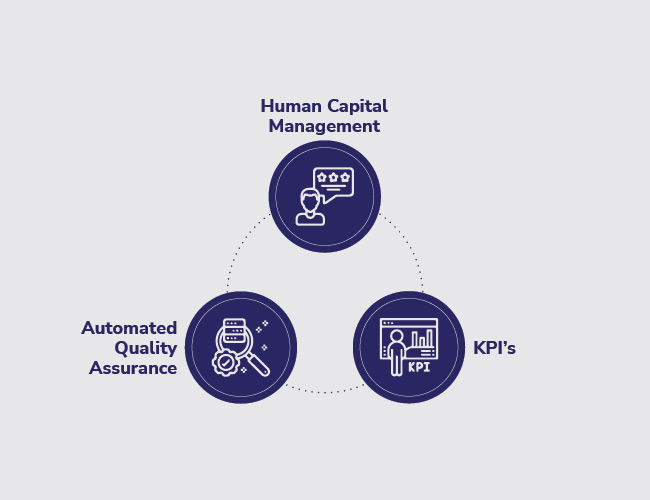

EnGRC not only facilitates a unified approach to risk assessment and management but also supports building an agile risk-aware culture, enabling timely, informed decision making. This ability to proactively prepare for changes in risks or opportunities rather than simply reacting to situations as and when they arise, helps minimize both the possibility of a risk occurring and its potential impact. EnGRC’s single source of truth brings previously siloed and manual processes into a centralised, interactive, co-ordinated program which is aligned with your business goals.

Know more. https://www.3i-infotech.com/engrc/

Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Mr. Umesh Mehta

Mr. Umesh Mehta Uttam Jhunjhunwala

Uttam Jhunjhunwala

Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N Ramu Bodathulla

Ramu Bodathulla

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan

Nilesh Gupta

Nilesh Gupta Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra