Intelligent Automation Led

Accounting Services

Challenges with legacy systems

According to a Forbes Survey, CFOs face delay in major business decisions due to non-availability of timely data which affects the bottom line.

- Almost 70% of organisations make significant business decisions with inaccurate financial data

- Automating finance and accounting can eliminate 40% of all transactional work since it's 50x faster while providing 99% accurate real-time data.

According to a Forbes Survey, CFOs face delay in major business decisions due to non-availability of timely data which affects the bottom line.

- Almost 70% of organisations make significant business decisions with inaccurate financial data

- Automating finance and accounting can eliminate 40% of all transactional work since it's 50x faster while providing 99% accurate real-time data.

CFO = Cognitive intelligence + Foreseeing capability + Optimizing productivity

Introducing iCFO

iCFO is a first-of-its-kind mobile-first low/no code one-stop-solution for all finance and accounting needs of a business. It’s a comprehensive approach to finance and accounting, designed with one purpose – manage costs, improve efficiency and maximize business growth.

10X

Productivity

99%

Accurate Data

100%

Financial Transparency

iCFO for Enterprises

We understand that large enterprises have disparate systems & complex requirements when it comes to financial management.

More accurate and efficient decision-making services

which are integrated . Viz :

- Fraud control detection

- Gate keeping mechanism – like real time alert

- Master data management

- Fast & accurate data extraction from POs, Invoice, unstructured data from emails

- Nudges & Recommendation for decision support

- Ledger & Bank Reconciliation

- Statutory Reporting & Audit checks

- Approval Matrix and

- Automated payment routing

- Cash management & forecasting

iCFO is a logic-driven automated system with cognitive and NLP capabilities that offers great benefits for large organizations in terms of cost, time, and efficiency

We understand that large enterprises have disparate systems & complex requirements when it comes to financial management.

More accurate and efficient decision-making services which are integrated . Viz :

- Fraud control detection

- Gate keeping mechanism – like real time alert

- Master data management

- Fast & accurate data extraction from POs,

Invoice, unstructured data from emails - Nudges & Recommendation for decision support

- Ledger & Bank Reconciliation

- Statutory Reporting & Audit checks

- Approval Matrix and

- Automated payment routing

- Cash management & forecasting

ICFO is a logic-driven automated system with cognitive and NLP capabilities that offers great benefits for large organizations in terms of cost, time, and efficiency

Save 43%

with Easy Invoice

- Ensures invoice processing through Intelligent data processing capabilities

- Invoice sourcing module with auto classification & prioritizations

- End to end processing of all payments with integrated workflows & approval mechanisms

- Remove high processing costs, payment delays & inaccurate processing

Increase working capital

with Automated Bill Book

- Improves working capital with accounts receivable automation, converts

trapped receivables into cash - Generates custom reports, monitors & tracks usage, visibility into cash inflow based on customer payment behavior

- Provides a comprehensive view of each customer’s account & collections status, resolves payment issues & reduces DSO

Automate ~90% of reconciliation

Intelligent Reconciliation

- A digitally-led, reconciliation solution that comes complete with a Data sourcing module with auto-classification & prioritizations

- Inbuilt Intelligent Data processing capabilities – that does data extraction, Indexing, Data Transformation, and enrichment

- Manages Data validation with full audit trail and exception handling

- Automates most of the reconciliation between 3rd party payments & ledger data

365 days of taking best business decisions

with Finance 360

- Analytics-driven CFO Dashboard with sales coverage and receivables position

- Provides cash flow projections and finance KPI analysis via a 360-degree dashboard with real-time insights

Services

Benefits of using automated F&A services

Saves 25,000 hours of manual work:

Focus on strategy

All manual accounting data input tasks like invoice processing can be automated so that you can focus on key strategies.

99% accurate data:

No more human errors

It effectively eliminates human errors arriving from manual accounting data input transcription. This is most important in an industry like the accounting

industry that relies on accurate, real-time financial data.

95% informed business decisions with

real time CFO Dashboards

With a click of a button, CFOs can get faster insights into the numbers, which can then be leveraged by financial analysts and accounting teams for improved business operations decision-making.

100% financial transparency:

Have centralised information

Because accounting automation now takes place online, it is easily accessible to everyone on cloud rather than being tied to a physical location.

Unlimited

integration capabilities

Integrations with 460+ platforms & most major

back-office operations, the highest within the category. (Read data from any form, place/shape agnostic data)

100% Scalable:

It evolves as you grow

A platform agnostic, easy bolt-on cloud solution that works with your existing systems, it automatically adapts to your evolving business needs so that the financial function meets the expectations of various stakeholders consistently.

We have designed to deliver value, resulting up to

operational efficiency

in TAT

processing costs

via OCR

duplicate payments

finance forecast reporting

operational costs

Case Studies

A leading mobile insurance company in South Asia

A leading mobile insurance company

in South Asia

A leading mobile insurance company in South Asia

A leading mobile insurance company

in South Asia

Industry Focus

Telecom

Banking

Insurance

Fin Tech

Edu Tech

E-Commerce

Retail

IT helpdesk

Logistics

FAQ’s

I already have accounting software.

Yes. We have integrations with 460+ platforms & most major back-office operations, the highest within the category. Our plug & play module is platform agnostic easy bolt on cloud solution that works with your existing systems.

How do we get started and how long does it take?

Our use cases show, It usually takes typically 4 to 6 weeks for onboarding depending on your requirements. Do reach out to us, our team of experts will be able to guide you.

Data security measures

We follow all data security protocols for cloud contact centers e.g. 2FA, Session Protection, Integrity Control, Data Masking etc.. Our platform is PCI- DSS,SOC 2 and ISO 27001 compliant.

What types of accounting services are available?

All services under accounts payable and receivable including invoice, payments, billing and banking payments.

What types of accounting software do you work with?

We work with all types of accounting softwares. We enable integration with 460+ platforms & most major back office operations, highest within the category Our plug & play module is platform agnostic easy bolt on cloud solution that works with your existing systems.

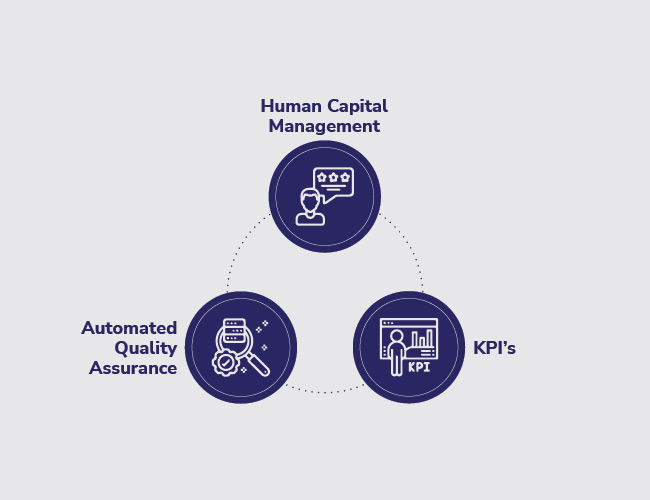

For managed services, what is the team strength?

We have over 100 industry experts, with extensive experience to guide you make the best use of our managed services.

Harish Shenoy

Harish Shenoy CA Uttam Prakash Agarwal

CA Uttam Prakash Agarwal Mr. Umesh Mehta

Mr. Umesh Mehta Uttam Jhunjhunwala

Uttam Jhunjhunwala

Ranjit Balakrishnan

Ranjit Balakrishnan Emmanuel N

Emmanuel N Ramu Bodathulla

Ramu Bodathulla

Rangapriya Goutham

Rangapriya Goutham Kiran Chittar

Kiran Chittar Sushant Purushan

Sushant Purushan

Nilesh Gupta

Nilesh Gupta Mohan TS

Mohan TS Sanjay Rawa

Sanjay Rawa Dr. Aruna Sharma

Dr. Aruna Sharma Mr.Avtar Singh Monga

Mr.Avtar Singh Monga Mr. Thompson P. Gnanam

Mr. Thompson P. Gnanam Ms. Zohra Chatterji

Ms. Zohra Chatterji Dr. Kalyan Krishnamoorthy

Dr. Kalyan Krishnamoorthy

Mr. Pravir Vohra

Mr. Pravir Vohra Viraf Sirvala

Viraf Sirvala

Amrita Gangotra

Amrita Gangotra